2,50,000 paying 20% down and executing a bond for the balance payable. For each of the following transactions, calculate the resulting cash flow and state the nature of cash flow viz., operating, investing and financing. Classify the following into Cash flows from (i) Operating Activities, (ii) Investing Activities, and (iii) Financing Activities while preparing a Cash flow statement under direct method:Ĭash from Operating Activities : Payment of Income TaxĬash from Investing Activities : Purchase of Fixed Assets, Sale of Long-term Investments, Interest Received, Dividend ReceivedĬash from Financing Activities : Issue of Share Capital, Payment of Divided, Payment of Interest, Repayment of Long-term Loans

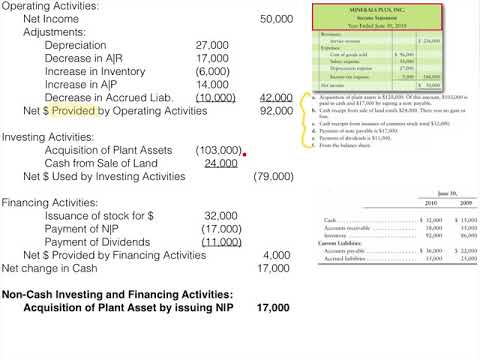

Prepare a format of ‘Cash Flow Statement’ under indirect method. (g) Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities. (f) Cash payment of wages, salaries and other payment to employees. (e) Cash payments to Creditors and Bills Payable. (d) Cash receipts for purchase of goods and services. (c) Cash receipts from Debtors and Bills Receivables. (b) Cash receipts from royalties, fees, commissions and other revenue. (a) Cash receipts from the sale of goods and rendering of services. Examples of Cash flows arising from operating activities are: As such, they include cash flows from those transactions and events which enter into the ascertainment of net profit or loss of the enterprise. 3 Operating activities are the main revenue generating activities of an enterprise.

Explain the method of calculating ‘Cash flows from Operating Activities’ under indirect method. For calculating ‘cash flow from operating activities’ from a given figure of ‘Net Profit’ earned during a year, how would you deal with (a) the redemption of debentures, (b) decrease in outstanding expenses, (c) increase in cash balance, and (d) decrease in inventory? For calculating ‘cash flow from operating activities’ from the given figure of ‘Net Profit’ earned during a year, how would you deal with (a) Increase in Trade Receivable, (b) Decrease in Inventory, (c) Decrease in Bills Payable, and (d) Increase in Trade Payables? DK Goel Solutions Chapter 6 Cash Flow Statement Class 12 Accountancy On our website we have provided solutions for all chapters given in the DK Goel Accountancy Book for Class 12.

This DK Goel Book for Grade 12 Accountancy will be very useful for exams and help you to score good marks in Class 12 accountancy examinations.

#Cash flow statement depreciation pdf

All solutions provided below can be downloaded in Pdf and are available for free.

Refer to the solutions provided below prepared by CBSE NCERT teachers Chapter 6 Cash Flow Statement DK Goel Class 12 SolutionsĬlass 12 Accountancy students should read the following DK Goel Solutions for Class 12 Chapter 6 Cash Flow Statement in Standard 12. This will help Class 12 DK Goel Accountancy students to understand the questions properly. We have provided solutions for all questions and have also provided short notes for each problem. Students in Class 12 who study accountancy and use the DK Goel Accountancy book to understand concepts of Chapter 6 Cash Flow Statement should understand the concepts and solve practice questions and exercises given at the end of the chapter. These DK Goel Class 12 Solutions help commerce students in class 12 understand accountancy and build a strong base in accounts. These DK Goel Accountancy Class 12 solutions have been prepared based on the latest book for DK Goel Class 12 for the current academic year by expert accounts teachers at. Read DK Goel Class 12 Accountancy Solutions for Chapter 6 Cash Flow Statement below.

0 kommentar(er)

0 kommentar(er)